Larry Berman: When to buy the dip

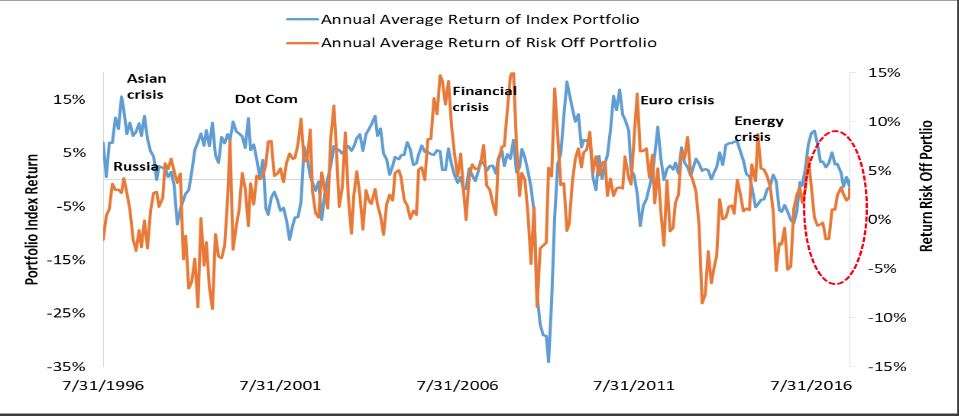

And when PMIs have dipped below 50, marking the “risk-aversion” phase, dip-buying has rarely paid, they said (see chart below). No matter what you do, buying when the market has experienced sharp corrections has been a successful strategy based on similar periods going back to 1960, according to data from Fidelity Investments. Dollar-cost averaging, a strategy of making steady investments in the market at regular intervals, will inherently capture some buy-the-dip opportunities. Or making a conscious decision to dive into the market — say, when you’ve received a bonus or a tax refund, for example — is another way. Similarly, investing in international stocks can help reduce risk in your portfolio.

Investors who saw the $55 per share stock as a bargain at $45 would find themselves unable to unload the stock a few weeks later when it fell below a dollar per share. What is an example of dip purchasing that we can draw from for context and additional information? An ideal one would be the ‘subprime lending crisis’ from back in the mid-2000s.

Afterward, it will experience a pullback because traders with pre-existing positions will take profit off the table. That being said, the positive earnings are an essential signal that suggests that the stock will continue its uptrend. When purchasing an asset after it has fallen, most traders and investors will go on to establish a price for controlling their risk. For instance, if a stock were to fall from $10 to $8, which is why they are buying. However, they also want to limit their losses if they wind up being wrong and the asset continues to drop.

Now Needham says the stock-price dip is a great buying opportunity. So buying on a small monthly dip of about 4% or more can be a decent move, since more often than not there is little to worry about and the slight discount you’re getting on stocks more than compensates. However, a better long-term strategy, with lower trading costs and potentially better tax treatment too due to more long-term capital gains is just to simply buy and hold a group of low-cost ETFs.

Then you can simply watch if the trend goes on or if you get stopped out, without the risk of any loss. In every chart, no matter which tradable asset, there are recurring wave patterns all the time, on any time frame. Beyond Bitcoin the classic crypto breakout scenarios – for which everybody is waiting all the time, with bull runs up to several hundreds to thousand of percentages – you can trade retracements generally, within impulsive price movements.

But UBS strategist Francois Trahan says that as signs of economic weakness mount, stocks become less likely to bounce back. Buying into stock https://forex-trend.net/ market dips has worked very well over the last decade, but UBS strategist Francois Trahan says he thinks it’s past its expiration date.

Text size Roku shares were trading up 5.3%, at $143.28, on Tuesday morning. Roku The Street fight is on. Rokushares plunged 15% on Monday after Morgan Stanley downgraded the company.

A stock that goes from being $10 to $8 may present a decent buying opportunity. However, there is an equally good chance that it may not.

An Example of Buying the Dip

- Exceptions and anomalies abound, depending on news events and changing market conditions.

- All trading strategies and investment methodologies should have some form of risk control.

- Generally speaking, the defensive sectors are considered to be health care, telecommunication, utilities and consumer staples stocks.

- They count on the uptrend continuing after the dip or drop.

However, there are others who may use the phrase when no uptrend is present. They do, nevertheless, believe an uptrend may take place in the future. Therefore, they are purchasing when the price drops as a means to profit from a potential future rise in price.

In the November 1 trading session, Twitter stock (TWTR) is trading at $29.64, down 1.10% from the previous session at the moment of writing. Moreover, the company plunged 24% over the past two weeks. I first start with a long-term perspective on the trend of the market. All will know this is the longest modern-day economic expansion without a recession (and most fragile), but we are getting closer to an inflection point suggested by the inverted yield curve, which is our best recession forecasting indicator. The basics of trend analysis continues to show a pattern of higher highs and higher lows for the U.S. stock market, which suggests that we should be buying dips.

MarketWatch site logo

If Monday may be the best day of the week to buy stocks, it follows that Friday is probably the best day to sell stock – before prices dip on Monday. If you’re interested in short selling, then Friday may be the best day to take a short position (because stocks tend to be priced higher on a Friday), and Monday would be the best day to cover your short. In the U.S., Fridays that are on the eve of three-day weekends tend to be especially good. Due to generally positive feelings prior to a long holiday weekend, the stock markets tend to rise ahead of these observed holidays. The middle of the day tends to be the calmest and stable period of most trading days.

You need to decide if you’re that nimble to be a trader vs. investor. For the more conservative investors, we have to look at the range around the December 2018 lows (235) to dip your toes in.

Does a best time of year to buy stocks exist? How about a best month to buy stocks, or to unload them?

System response time and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. On Tuesday, Needham analyst Laura Martin reaffirmed her Buy rating on Roku shares, predicting strong growth for the third-party streaming services on its platform. The company receives a revenue share when customers sign up for other services using its software or devices. Pay attention to the number of open call and put contracts, too. In Twitter’s case right now, the number of open calls at the $30.00 strike price outweigh the open puts by around 69%.

Nonetheless, hopefully knowing that dips aren’t, on average, a serious problem can give you more conviction in a fundamental buy and hold approach. So, should we all do this, what’s the catch? Well, there is a catch and it’s https://forex-trend.net/ that the strategy keep you out of the market quite a lot of the time. You get the opportunity to employ this strategy slight more than once a year, on average, and as, described it has you then invested for 3 months.